Inventory Accounting System

Connecting Inventory and Accounting in One Software

Finale gives you the clarity and control you need to confidently manage your inventory bookkeeping with the power of an inventory accounting system.

Simplify Complex Financial Reporting

What Is Inventory Accounting?

Inventory accounting is the process of valuing, recording, and reconciling inventory activity to reflect its financial impact. With the right system, businesses gain accurate, real-time visibility into inventory costs—critical for profitability, tax reporting, and audits. Inventory accounting depends on detailed purchase orders (POs), chart of accounts tracking, showing the clear cost of goods sold (COGS), landed cost calculations, and use of weighted average costing.

An Inventory accounting system tracks, values, and reports on inventory transactions to ensure accurate financial records. It connects stock movements to the cost of goods sold (COGS), supports accounting methods like weighted average, and integrates with platforms like QuickBooks Online and Xero. This system is key for understanding profitability, preparing for audits, and avoiding manual spreadsheet errors.

Automated Inventory Accounting System Without Spreadsheets

Manual tracking of inventory costs in spreadsheets is error-prone and nearly impossible, especially when trying to calculate average cost or reconcile stock across locations.

Finale's inventory accounting software automates cost tracking, and real-time valuation, syncing with QuickBooks Online and Xero to help you stay accurate without manual number crunching.

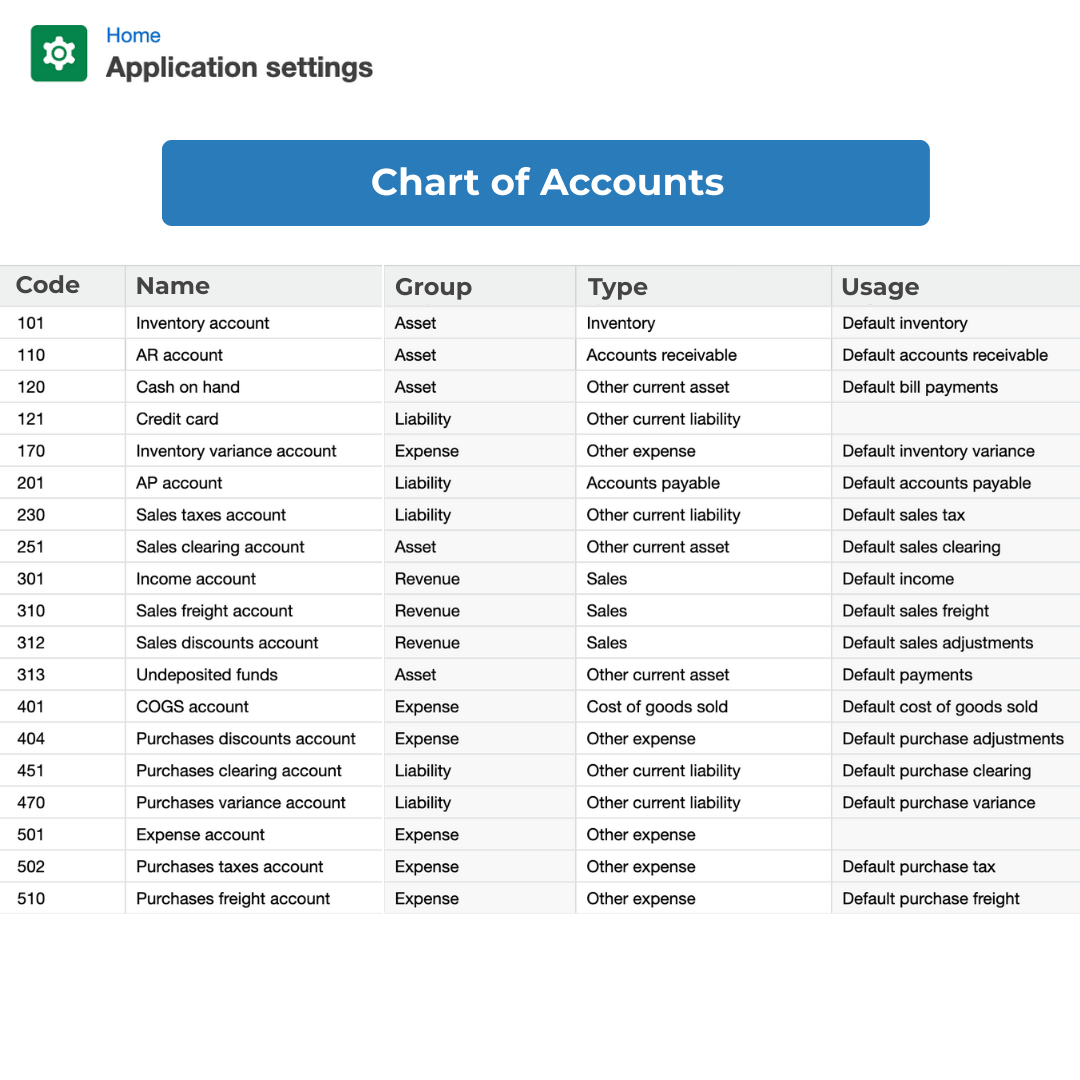

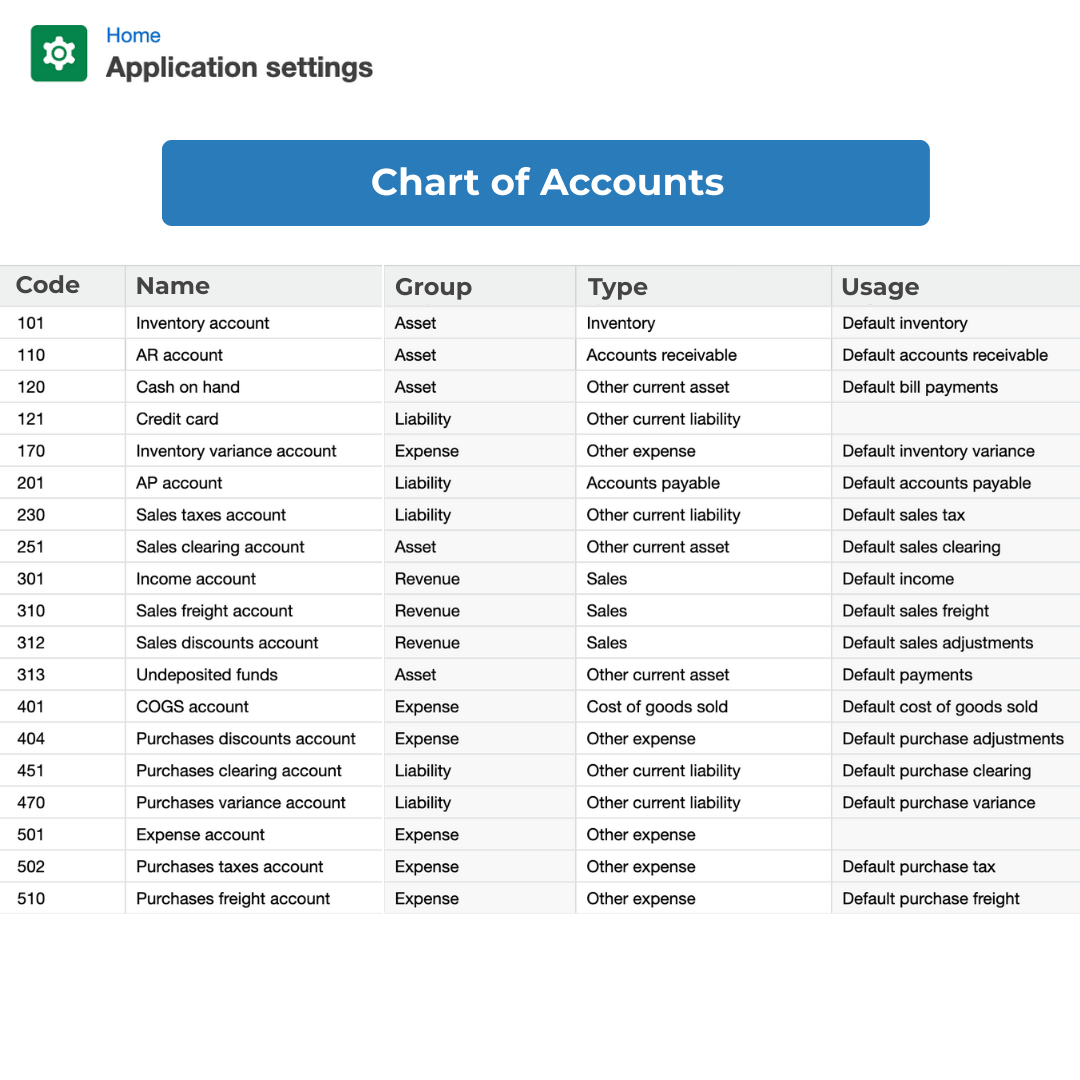

Inventory Chart of Accounts

Many systems lack the flexibility to seamlessly connect inventory activity to your accounting system’s chart of accounts. For sellers managing multiple brands, warehouses, or ecommerce channels, this often results in fragmented bookkeeping, time-consuming reconciliations, and limited financial insight.

Finale solves this with a fully customizable and flexible chart of accounts mapping that aligns your inventory data directly with your financial reporting needs. Whether you're a DTC brand, selling across multiple sales channels, or a wholesaler with multiple fulfillment locations, you can configure account mapping to match how your business operates.

Track COGS, revenue, inventory adjustments, and purchase activity by brand, selling channel, warehouse location, product category, or even individual SKU. Finale ensures your accounting stays clean, accurate, and audit-ready, so your finance team has the visibility and control they need to scale confidently.

COGS Visibility

Cost of Goods Sold (COGS) is one of the most critical metrics for understanding profitability—but it’s also one of the easiest to get wrong. Many businesses struggle to track COGS accurately across orders, SKUs, and channels, leading to mispriced products, margin erosion, and poor forecasting decisions.

Finale solves this with precise, real-time COGS tracking that’s deeply integrated with your inventory data. Every unit sold reflects actual landed costs—including purchase prices, freight, and additional adjustments—so you can confidently understand your true profit margins.

Whether you’re analyzing profitability by product line, identifying underperforming SKUs, or preparing financial statements, Finale’s detailed COGS reporting gives you the visibility you need to make data-driven decisions with confidence.

Inventory Accounting System for Valuation & Audit Prep

Closing out accounting periods for inventory can be time-consuming, especially when stock levels and COGS don’t align. Without an IMS, sellers have unclear or inaccurate profitability tracking and don’t know the value of their sitting stock.

Finale keeps inventory and accounting in sync, so end-of-period reporting becomes straightforward and less stressful. See who your best customers were, which products were the most profitable, the value of your stock in storage, shrinkage, and more.

Landed Cost & Weighted Average Cost

True inventory costs are guesswork without visibility into landed costs, average cost fluctuations, or proper invoice tracking. This often leads to inaccurate COGS, margin errors, discrepancies, and even overpayments.

Finale supports weighted average costing, so your inventory valuation stays accurate as purchase prices change. You can also track landed costs like insurance, freight, and duty —protecting your margins and preparing you for audits.

3-Way Matching for Accurate and Controlled Accounting

Finale’s 3-way matching compares purchase orders, receiving records, and supplier invoices before recording transactions, helping internal bookkeepers prevent overpayments and ensure clean data entry. Controllers benefit from stronger internal controls, accurate COGS, and streamlined month-end close. For external accountants, this means fewer discrepancies to reconcile, reliable financials to review, and faster audit preparation. It’s a simple but powerful tool to keep inventory and financial records aligned across the board.

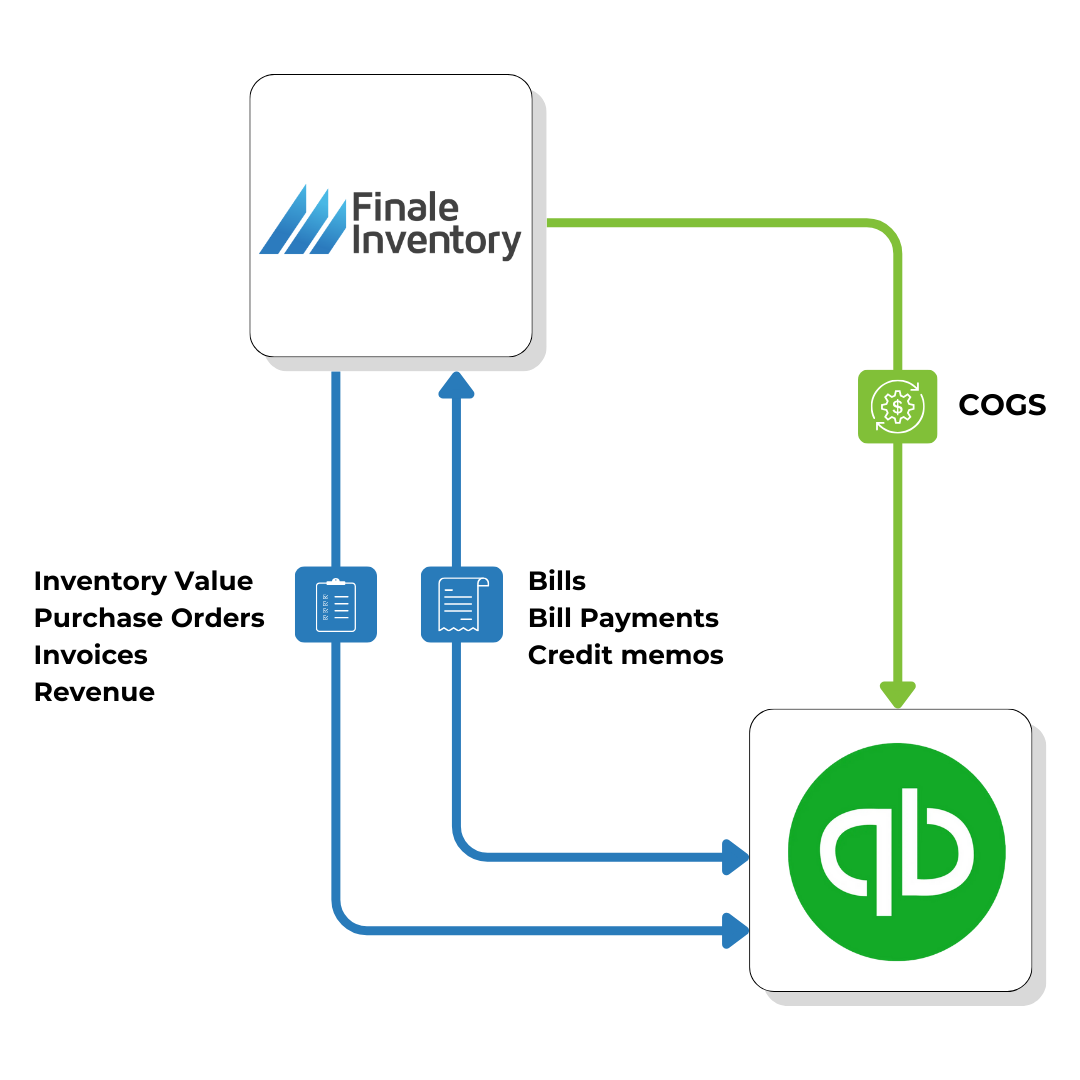

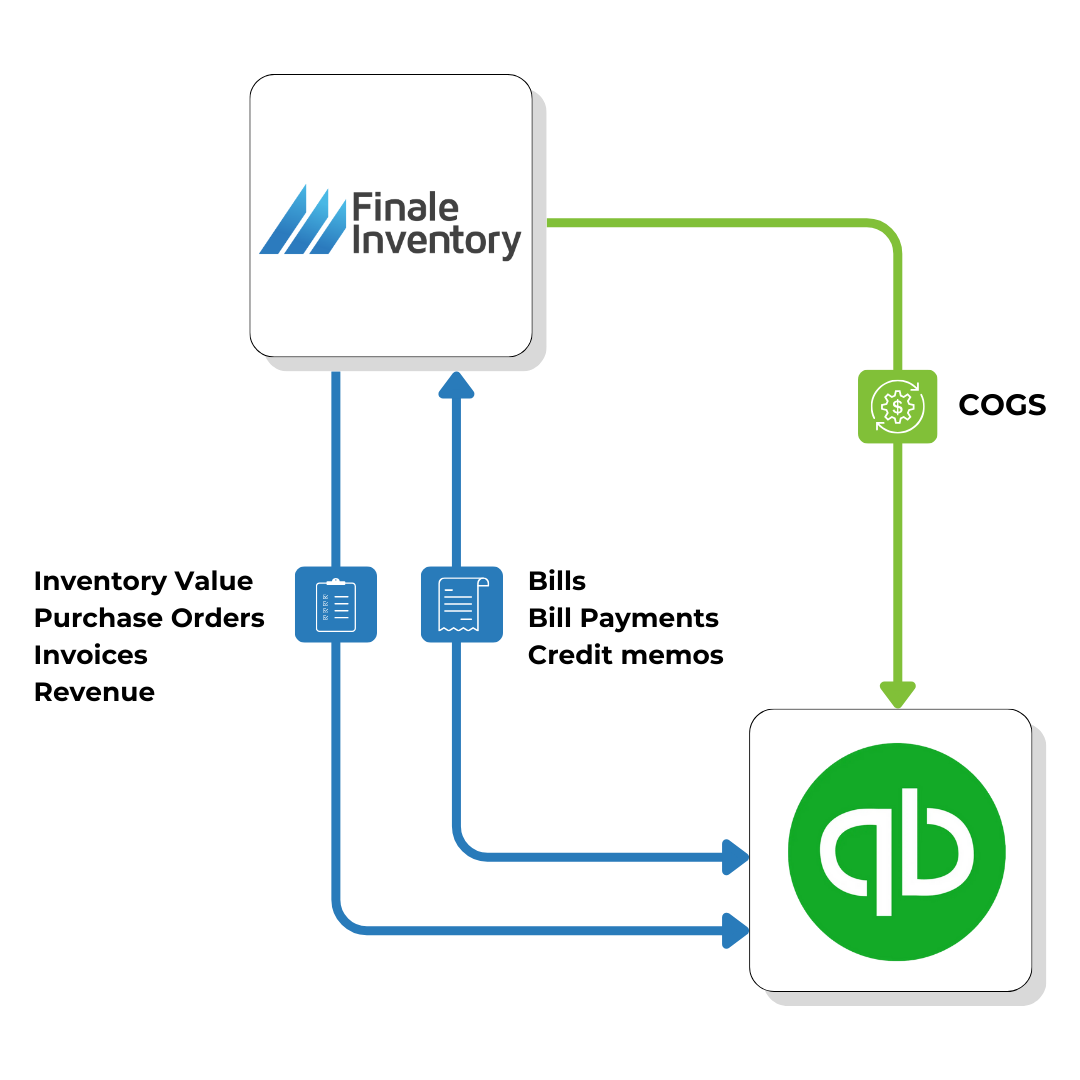

QuickBooks Online & A2X Integration

Manually entering purchase orders, sales, and COGS data into your accounting system leads to errors, delays, messy reconciliations, and piles of paper records that are hard to organize and audit.

Finale syncs with QuickBooks Online and A2X to automate your inventory accounting, eliminating manual entry and enabling accuracy. You'll get clean, timely, and paperless record-keeping for your financial data.

"We have been able to improve our receiving, order accounting, inventory maintenance, returns, shipments.... Every aspect of our ecommerce business was improved by the implementation of [Finale]."

- An inventory accounting system tracks the value and movement of goods throughout the business cycle—from purchase to sale. It helps ensure inventory levels and financial records stay accurate by assigning costs to products and recording changes in quantity. Finale Inventory automatically logs every stock event—like receiving, shipping, or adjustments—so your records stay current. For instance, if you receive 100 units of a product at $100 each, Finale immediately reflects a $10,000 increase in inventory value and applies that cost to future sales.

- Pros of an Inventory Accounting System and Software:

An inventory accounting system provides better control, transparency, and efficiency in managing stock and cost data. It reduces errors by automating calculations and syncing inventory values with your accounting system. Finale Inventory allows you to track stock across locations, manage costs accurately, and generate reports to support financial audits or forecasting. For example, when you sell 40 out of 100 units purchased at $50 each, Finale automatically records a $2,000 cost of goods sold and reduces inventory value accordingly. - Cons of an Inventory Accounting System and Software:

While inventory software offers major advantages, it requires proper setup and training to avoid mistakes. Misapplied cost data or missing entries can lead to discrepancies in financial reports. Finale Inventory minimizes these risks with user permissions, transaction logs, and validation prompts, but careful configuration is still essential. For example, if you forget to include a sublocation for newly received stock, those 100 units may not appear correctly in reporting until the entry is corrected.

Watch the step-by-step video guides

Key inventory accounting practices include tracking accurate purchase costs, recording physical counts, and applying consistent valuation methods. You must also track and justify damage, shrinkage, or returns adjustments. Finale Inventory supports all of these by enabling reason codes for stock changes, storing historical transaction logs, and letting users apply corrections without overwriting prior data. If you count 95 units on the shelf when Finale shows 100, you can enter a 5-unit variance with a reason like "damaged" to adjust your records cleanly.

Inventory accounting creates records for each inventory-related event, such as receiving goods, selling them, or adjusting quantities. These entries impact key accounts like inventory assets and cost of goods sold (COGS). Finale Inventory tracks each of these automatically. For example, receiving 100 items at $25 each logs a $2,500 inventory asset. When 30 items are sold, Finale records $750 to COGS and updates your on-hand value to $1,750.

Suppose you buy 100 toolkits for $10 each, totaling $1,000 in inventory value. You later sell 60 toolkits. Finale Inventory automatically calculates the cost of goods sold at $600 and reduces the remaining inventory value to $400. These records flow into your reports and—if integrated—your accounting software like QuickBooks Online, ensuring profit margins and financial data are accurate.

With the average cost method, you calculate the mean cost of your inventory over time. For example, if you purchase 100 units at $10 each, then another 100 units at $20, the average cost per unit becomes $15. Selling 50 units would result in $750 in COGS (50 × $15). Finale Inventory uses this method in its reporting tools when you want to view basic cost metrics over a defined period.

Finale Inventory uses the Weighted Average Cost (WAC) method for real-time cost tracking, meaning it recalculates the average cost of each product every time new stock is received. Unlike a simple average, WAC factors in the quantity and cost of each purchase to determine the new average. For example, if you buy 100 units at $10 and later 200 units at $15, Finale calculates the WAC as [(100×10) + (200×15)] ÷ 300 = $13.33 per unit. If you sell 50 units, Finale deducts $666.50 (50 × $13.33) and automatically adjusts your inventory value, providing an accurate and audit-friendly valuation at all times.

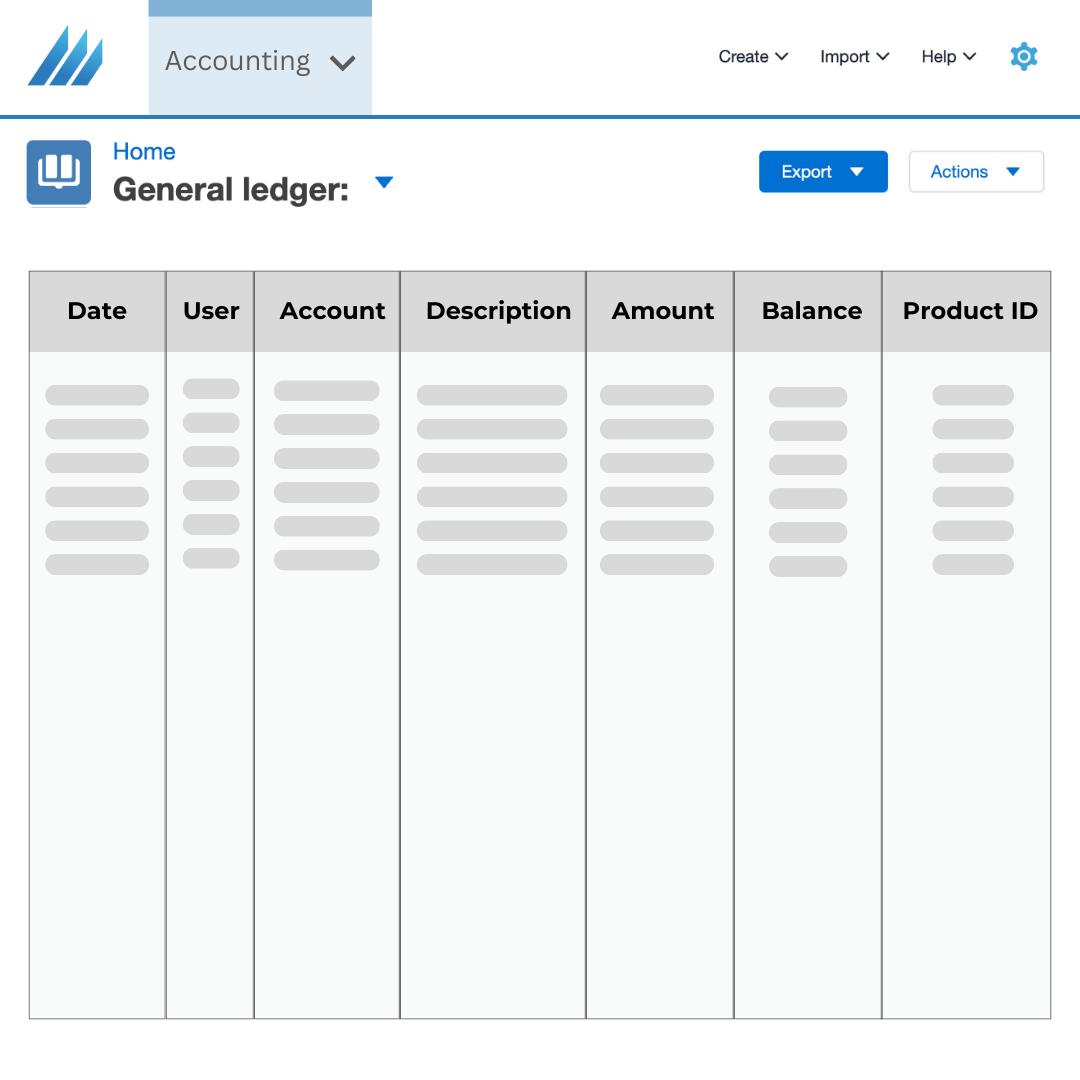

Finale Inventory provides robust tools for inventory reconciliation and identifying discrepancies.

First, Stock Takes allow users to input actual physical counts and automatically calculate and log any variances, which are key for ensuring accurate financial records.

Second, Finale’s built-in reports give detailed visibility into inventory gains or losses, allowing accounting teams to investigate and justify these changes.

Additionally, the Stock History tracks all inventory transactions, enabling auditors to trace stock movements and identify anomalies.

For ongoing analysis, reports can be created and emailed to finance teams, supporting regular reviews and compliance.

Lastly, Finale’s integration with QuickBooks Online, Xero, and A2X ensures that all relevant inventory and cost adjustments are synced properly, maintaining financial integrity across platforms.

Transaction flow types supported:

- Purchase shipment delivered

- Purchase bill posted

- Purchase bill payment posted

- Supplier Credit Memo posted

- Sale shipment shipped

- Sales invoice posted

- Invoice payment posted

- Sales return shipment received

- Stock change/stock take committed

- Build completed

- Average cost change posted

- Journal entry posted