Landed Cost Software

Automated Landed Cost Calculations

Finale Inventory’s built-in landed cost feature automatically accounts for costs and assigns them where they belong. Make better purchasing and pricing decisions with software for landed costs.

Simplify Your Accounting Process

Accurate Cost Allocation

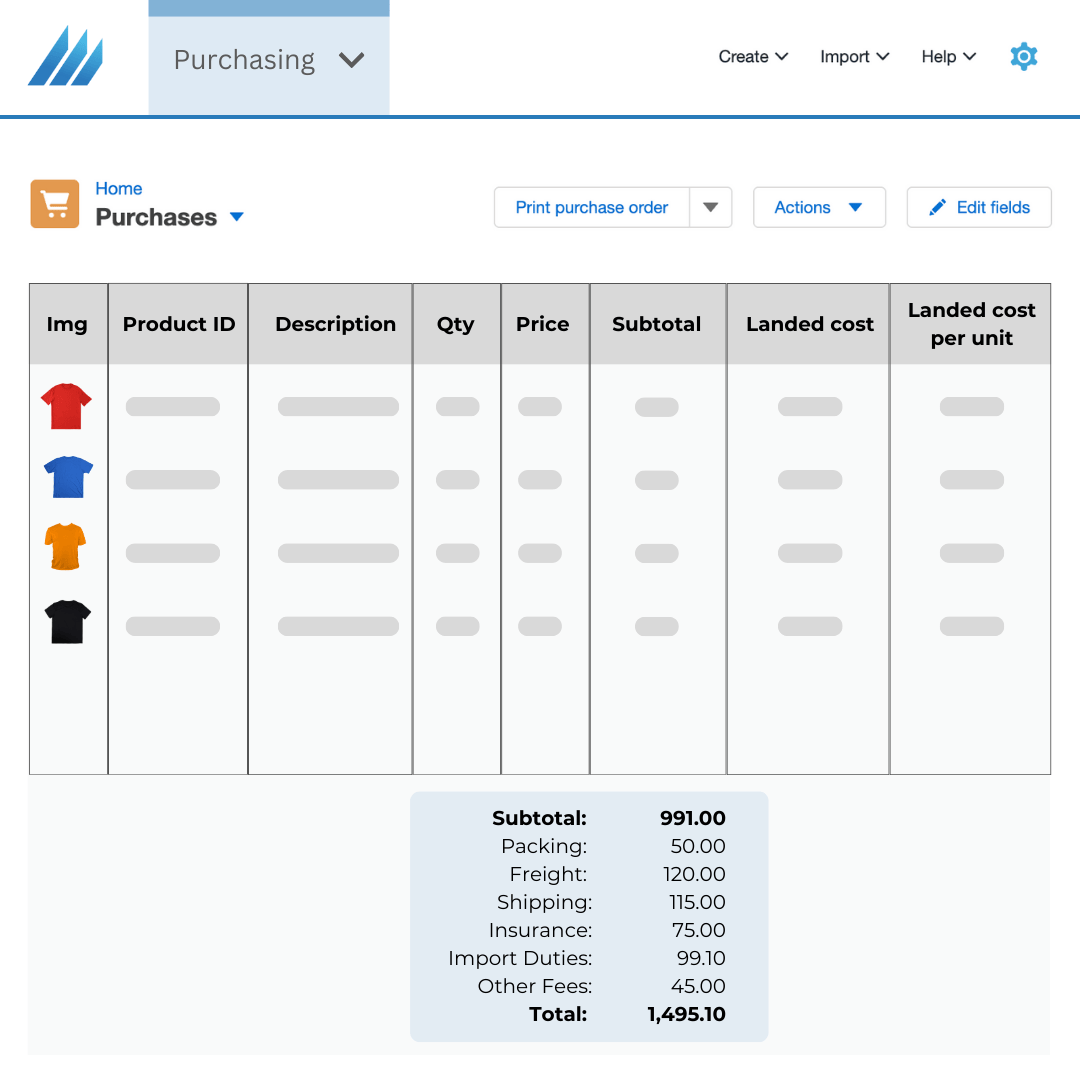

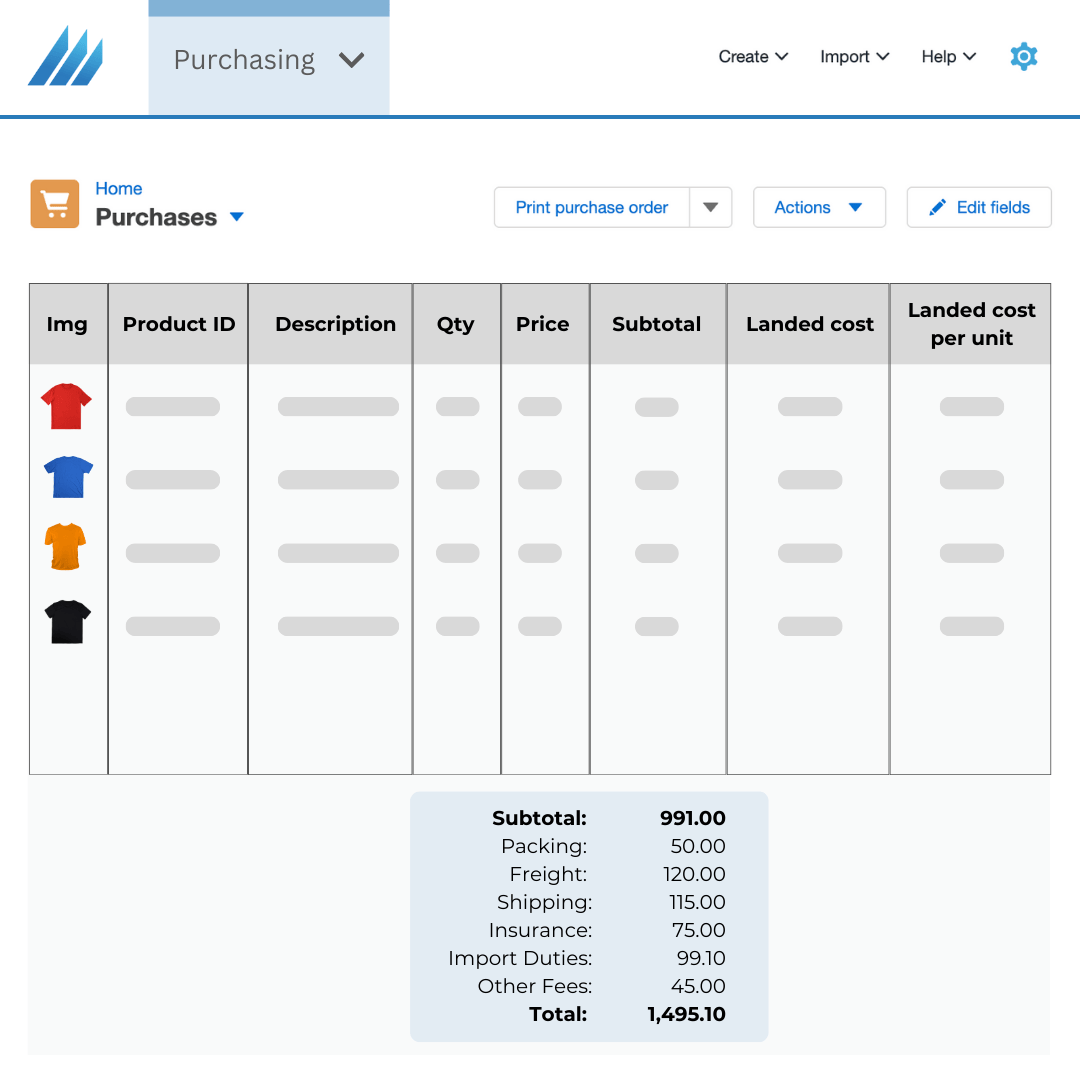

Businesses struggle to fairly allocate costs like shipping or import fees across multiple purchase orders or line items. Manual methods often result in inconsistent data and unreliable profit tracking.

Finale landed costs distribution is based on value, quantity, weight, volume, or total quantity. This ensures your product costs are always complete and accurate, without relying on spreadsheets.

Clear Financial Visibility

Many companies don’t see the real cost of their products until it’s too late, making it hard to make smart pricing or purchasing decisions. Manual landed cost calculations are prone to error. This lack of financial visibility impacts cash flow and margins.

With built-in landed cost tracking, Finale provides real-time visibility into your true inventory costs. Make confident decisions with true and up-to-date product costs.

Automated Landed Cost Calculations for Simplified Accounting.

Stock Valuation

Without accurate landed costs, you don’t know the true value of the stock in your warehouse and how much money is tied up in storage. This leads to over or undervaluing inventory and distorted asset valuation.

Finale's landed cost software reflects the value of your inventory, providing a more accurate picture of what your stock is truly worth, no matter how many warehouses or store locations you have. Align your inventory records with financial reporting. Have confidence in your inventory stock valuation, reduce manual entry, and improve audit readiness.

Landed Cost Software for Ecommerce Sellers

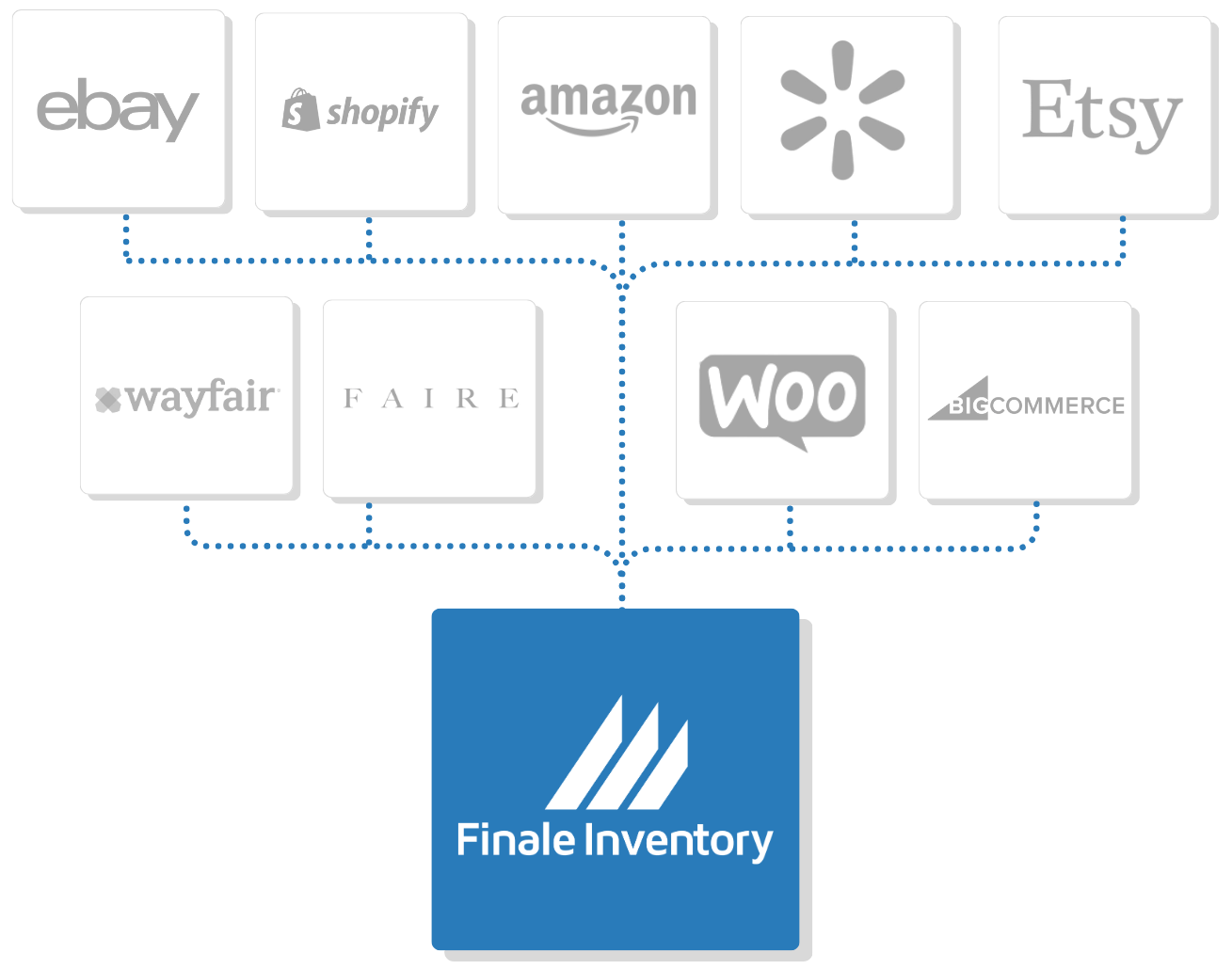

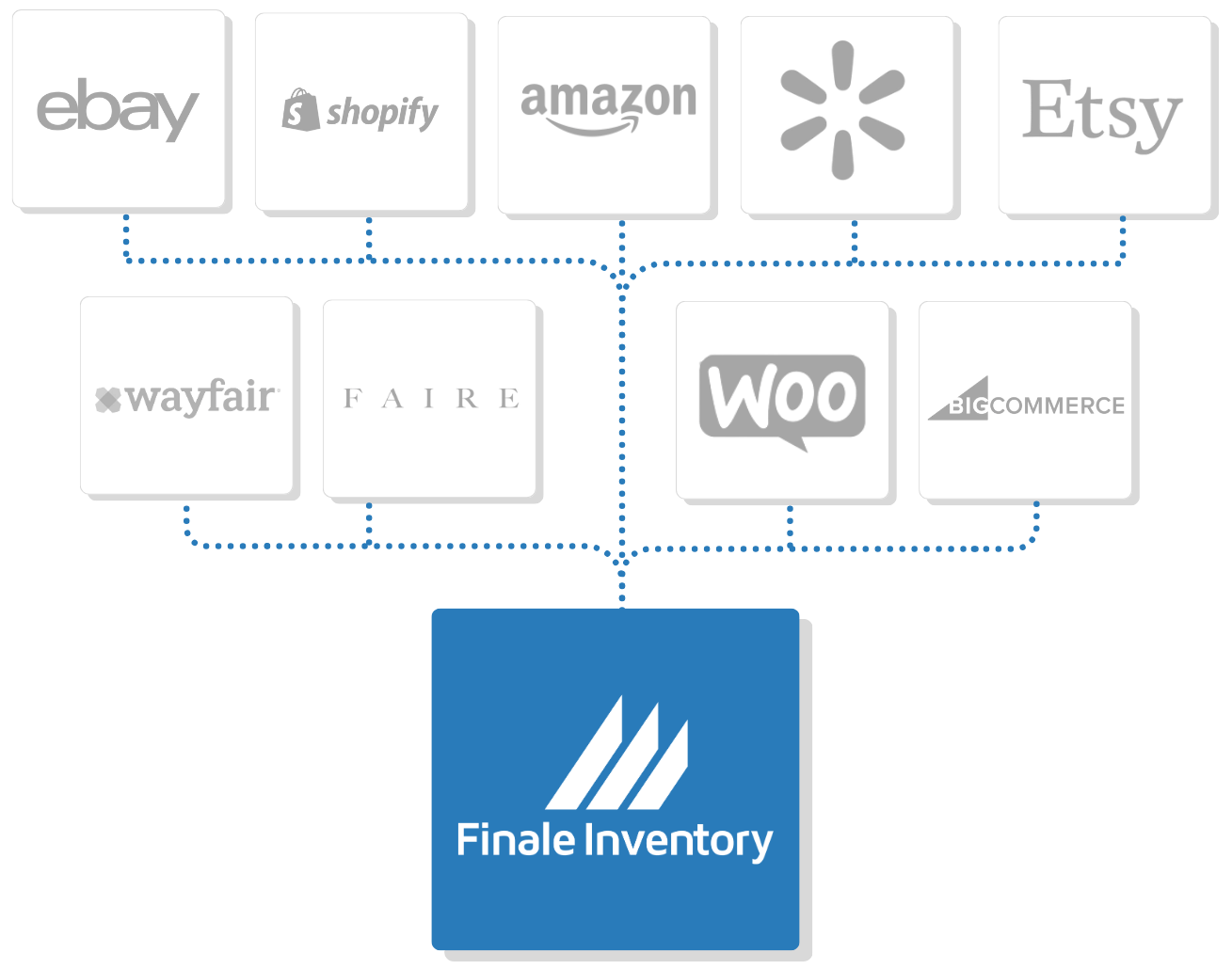

It’s difficult to track costs across systems, especially for multichannel ecommerce sellers. The margin input on the selling channel or marketplace may be misinformed since the financials are not calculated correctly across your inventory tools and spreadsheets. Even if you use QuickBooks Online or Xero, sellers still need to manually combine everything.

Finale will combine all of your costs in one place. Finale was built to be your inventory hub, giving you visibility over your true costs so your listings are priced correctly.

A2X: Sync Accurate Landed Costs

Overstated margins and unreliable reports are common when true landed costs aren’t captured. Freight, insurance, and other hidden costs can easily distort your COGS — and your bottom line.

Finale Inventory directly integrates with A2X, automatically sending accurate COGS and landed cost data for seamless accounting and fast, reliable reconciliation.

Stop guessing. Start knowing — with real landed cost visibility from inventory to accounting.

"We have been able to improve our receiving, order accounting, inventory maintenance, returns, shipments.... Every aspect of our ecommerce business was improved by the implementation of [Finale]."

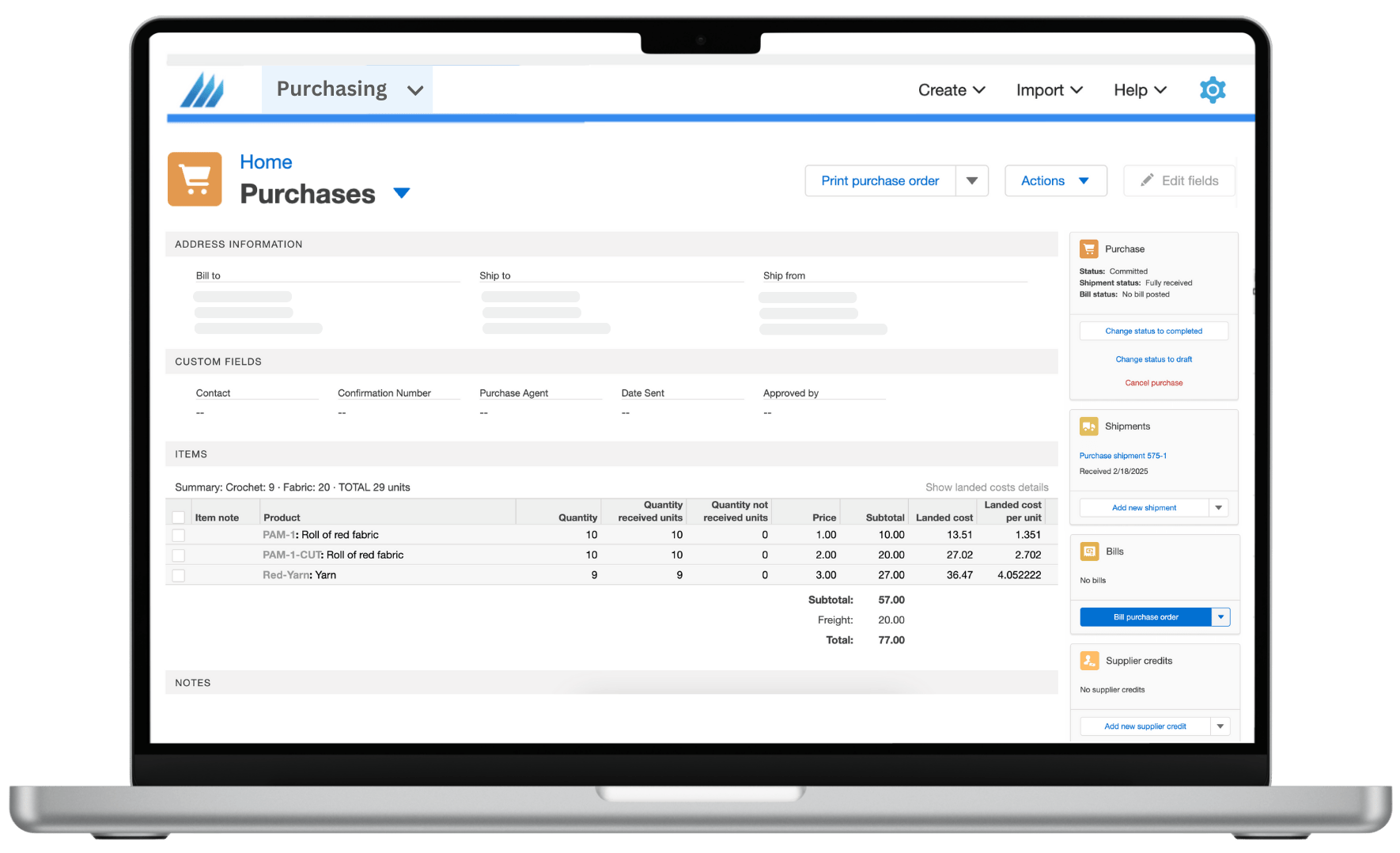

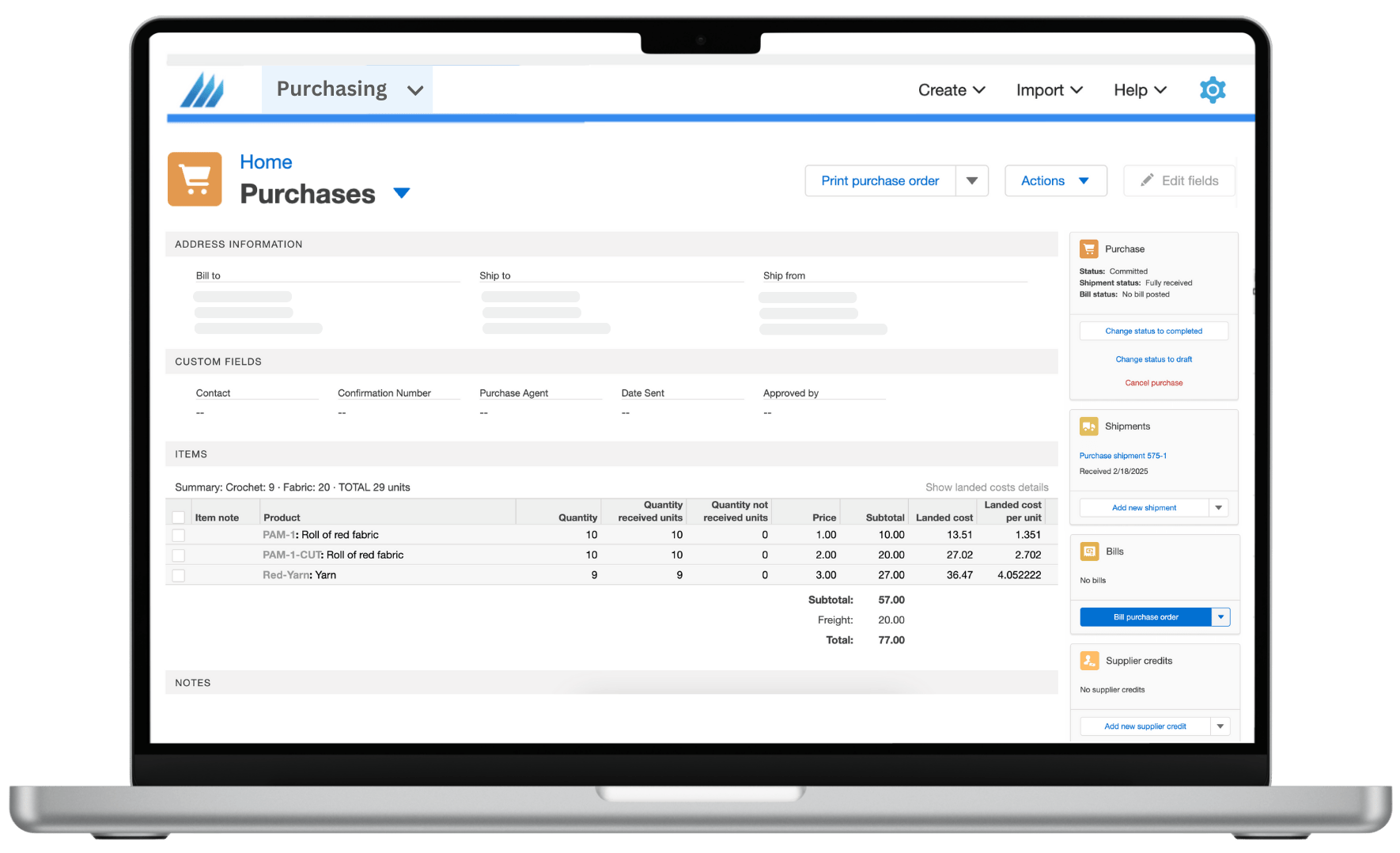

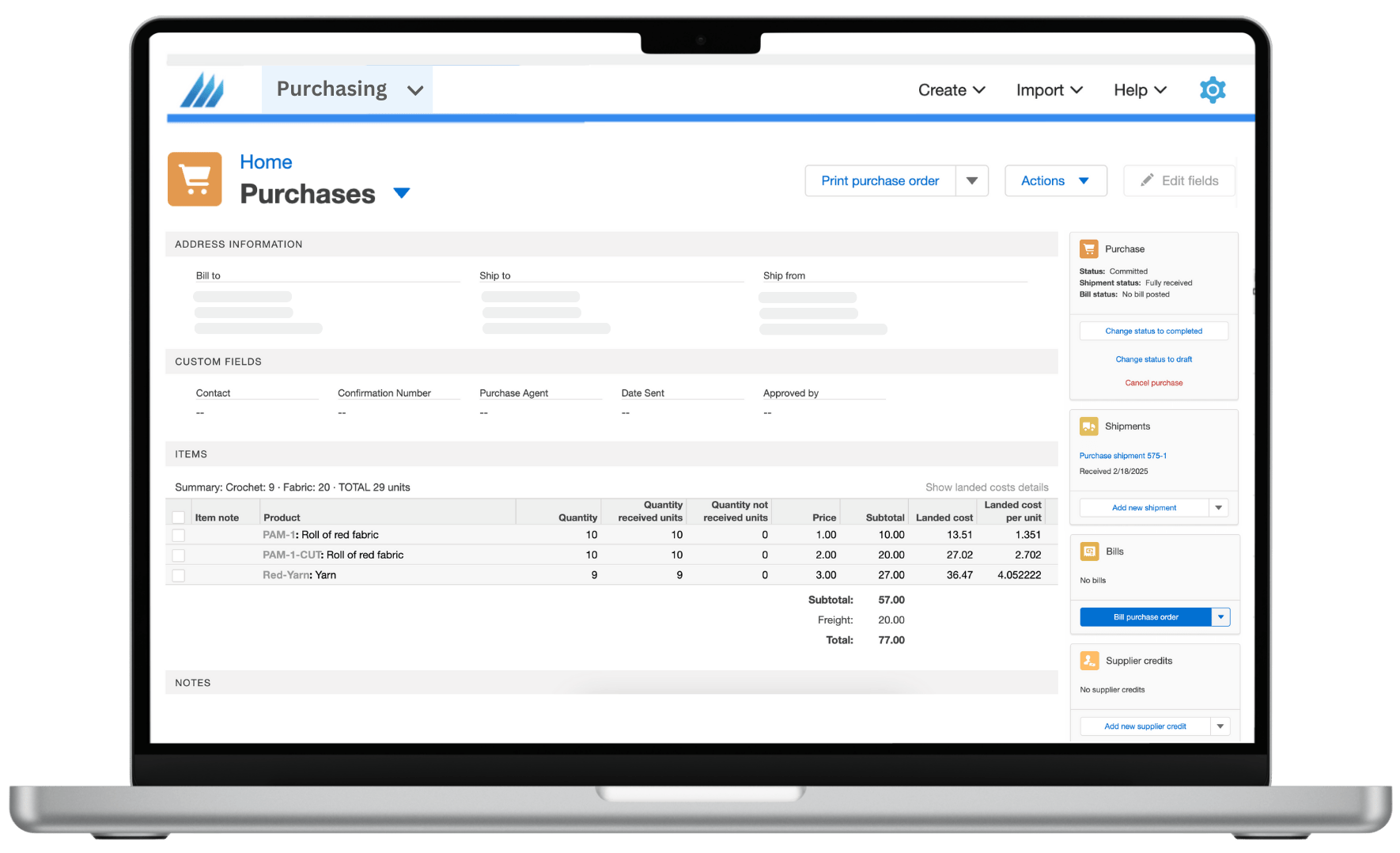

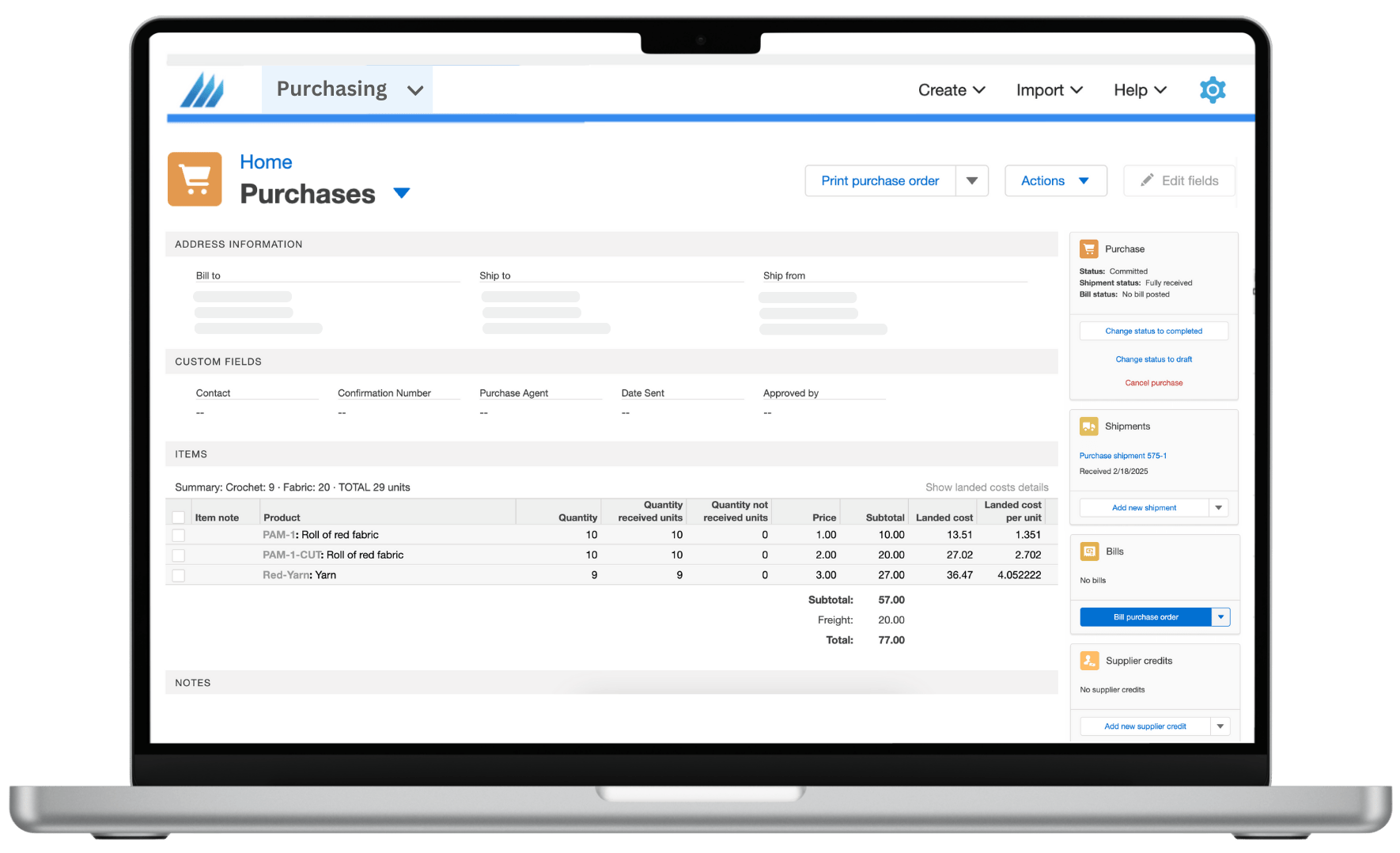

Let’s say you purchase 100 product units at $10 each, and you pay $200 in shipping. The total landed cost is $1,200, or $12 per unit when the shipping cost is evenly distributed. In Finale Inventory, you can enter the $200 shipping fee as an adjustment on the purchase order. Finale then spreads that cost across the received units based on your selected allocation method, such as by quantity or order subtotal, so your inventory reflects the full cost of acquiring each item.

Watch the step-by-step video guides

Let’s say, for example, you run a clothing company that’s based in the United States, and you create a purchase order for 500 pairs of jeans from a Chinese supplier. The jeans cost you $20 per unit, which comes to a total of $10,000. The duty is two percent, the freight for the shipment costs $800, and insurance costs $500. An import tax of 10 percent is charged on the final value of the imported goods.

Before you calculate your landed costs, you should ensure all currencies are converted to your local currency — in this case, the United States dollar (USD). Remember to take into account the exchange rates you’ll receive. Then, you can add up your costs.

- Total product costs: 500 units times $20 equals $10,000

- Freight: $800

- Customs: $10,000 times two percent equals $200

- Insurance: $500

- Tax: $10,000 times 10 percent equals $1,000

Based on these numbers, your total landed cost would be $12,500.

To calculate the landed cost per unit — if you define a unit as one pair of jeans — you would divide $12,500 by 500, which is the number of units you shipped. That comes out to $25 per unit landed cost, which is 25% more than the $20 product cost of a pair of jeans.

Landed cost software ensures you’re not underestimating product costs, which is critical for accurate pricing, margin analysis, and financial reporting. It saves time by automating cost allocations and preventing costly mistakes in manual calculations. Finale Inventory makes this easy with built-in features that let you assign landed costs directly within purchase orders. Once applied, these values automatically update the average cost of each product, ensuring your cost of goods sold (COGS) and inventory valuation are always correct.

Recording inventory in accounting means tracking purchases as assets, reducing them as you sell, and recording the cost of goods sold. This ensures your financial reports show the correct inventory value and profit margins. Finale Inventory supports this workflow by logging all inventory-related transactions and syncing with QuickBooks Online and Xero. When you receive inventory, it creates entries for the asset value, and when items are shipped, Finale calculates COGS and logs that as an expense, keeping your accounting books aligned with your inventory movements.

Setting up landed cost tracking in inventory software involves defining which cost types to track (e.g., shipping, import taxes) and how they should be allocated to products. In Finale Inventory, this is done by configuring adjustments within the purchase order screen. You can label the cost (e.g., “Freight” or “Import Fee”), assign it to an expense account if integrated with QuickBooks Online or Xero, and choose your allocation method—such as by quantity, cost, or weight. Once configured, Finale automates the distribution of those costs, keeping product valuation consistent and accurate.

You can choose from the following

- Subtotal (value)

- Quantity

- Weight

- Volume

- Equally

Product costing in Finale Inventory is primarily handled through a combination of purchase orders and average costing. Finale’s software can handle average weighted costs. This along with your landed costs gives you deep insights into your inventory and the true cost per unit which lets you price the item for sale at the right price.

Yes, Finale does support partial receiving of purchase orders. When you receive fewer units than what was ordered—like ordering 100 but only receiving 90—you can enter the actual quantity received. Finale will then track the remaining quantity (in this case, 10 units) as still outstanding on the purchase order, allowing you to complete the rest of the shipment later when those items arrive.

Finale has many easy-to-download reports you can send to your bookkeeper, accountant, or CPA. These range from inventory valuation, to purchase history, sales history, and much more.